That noted, several online-only banks, including Bask and SoFi, are offering savings account APYs that are higher than money market accounts on this list (2.20% and 2.00%, respectively).

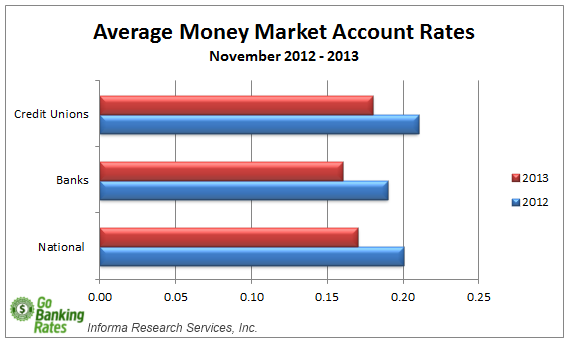

(An APY - which is the rate of return earned on an investment, including compound interest - is effectively your interest rate for the year.) For either account, anything beyond 1.00% is considered a robust interest rate. Savings accounts and money market accounts are currently offering around the same APYs. Should I open a savings account or a money market account? Here are the best money market accounts available today - but first, some important notes about insurance and withdrawal limits for money market accounts. They're also particularly attractive now that annual percentage yields, or APYs, are starting to rise as a result of the Federal Reserve's recent interest rate hikes.Īs a general rule of thumb, anything over a 1% APY for a money market account is considered a good rate. If neither of these requirements are an issue, a money market account can offer a safe way to grow your savings, while still offering access to your cash. You can typically earn more interest with a money market account than with a traditional savings account, but money market accounts often require higher initial deposits or minimum balances. Because money market accounts offer competitive interest rates, they can be a good way to save up, especially if you think you might need to pull from the account on occasion. But unlike a traditional savings account, money market accounts typically offer checking account features, including access to your cash through debit card withdrawals and physical checks. At Mid Penn Bank, we’re happy to help you determine which type of account is the best fit for your needs.Ģ – Overdraft and returned item fees may apply.A money market account is a type of savings account that earns you interest.

Look no further than your local PA community bank to learn more about money market accounts and start saving today.

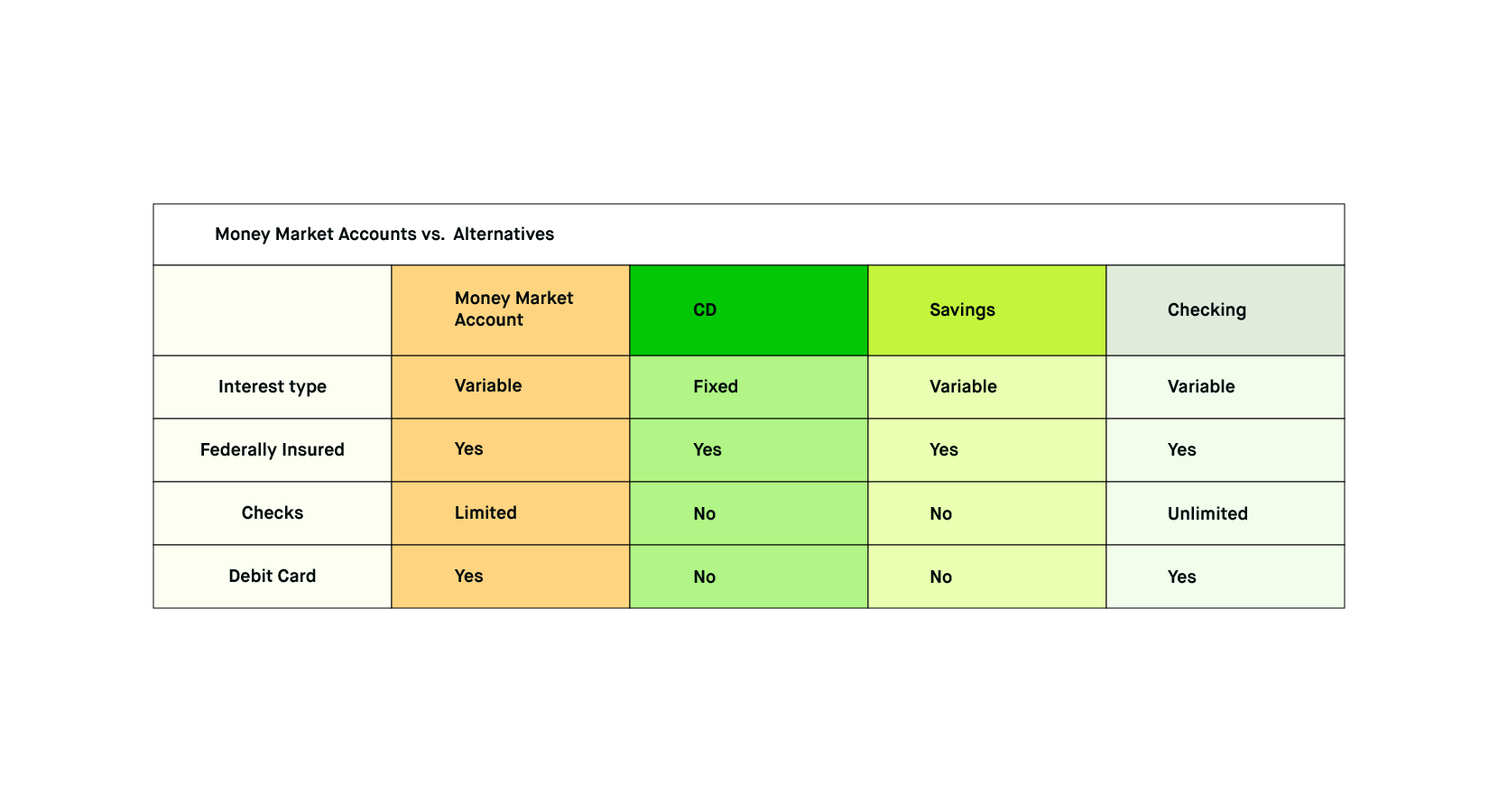

Get the Best Money Market Rates at Mid Penn Bank Savings rates may also vary, so you should check with your local bank to ensure that you’re getting the best rate. Some banks require a minimum deposit to open your account. The terms of your money market account may vary based on your bank. Your interest rate is higher in many cases than it would be with a traditional savings account. Your money market account comes with an interest rate similar to a savings account. However, keep in mind that there is a limit for the number of checks you can write each month. Like a checking account, a money market account allows you to write checks and, in many cases, use a debit card. Think of a money market account as a blend between a standard checking and savings account. How Are Money Markets Different From Checking and Savings Accounts? Limited check writing and transfers (Six transfers per month to another account or to third parties by preauthorized, automatic or telephone transfer, including checks.).Our Flex Money Market account gives you the safety net of a few checks each month while your savings grow.Įnjoy the perks of our Flex Money Market account, which rewards higher balances with higher interest rates. You’ll also have the benefit of accessing the money in the account when you need it. In the rare event that your bank goes under, your savings account is still protected. Insurance ProtectionĪnother benefit of money market accounts is that they are insured. Money market savings rates typically grow higher as your balance increases, making it easier for you to meet your savings goals. You’ll earn more interest than you would with a checking or savings account. One of the main advantages of a money market account is the interest rate. If you are looking to save but also want the ability to write checks and access funds with a debit card, our Flex Money Market account is perfect for you. It has a few unique features that separate it from other accounts, so we’ve put together a guide to help you decide whether a money market account is right for your needs. Commercial Real Estate & Construction FinancingĪ money market account is a type of bank account that bears interest.

0 kommentar(er)

0 kommentar(er)